| Structural Element for Building 1 |

| Bldg Type |

MOBILE-MFG HOME |

| Exterior Wall 1 |

Aluminum |

| Year Built |

1976 |

| Air Condition Desc. |

HTG & AC |

| Heat Type |

FORCED AIR DUCT |

| Heat Fuel |

ELECTRIC |

| Bed Rooms |

1 |

| Full Baths |

1 |

| Half Baths |

0 |

| Roof Structure |

FLAT |

| Roof Cover |

METAL CORRUGATED OR RIBBE |

| Interior Wall 1 |

PLYWOOD PNL |

| Interior Wall 2 |

NONE |

| Floor Type 1 |

CARPET |

| Floor Type 2 |

NONE |

| Stories |

1 |

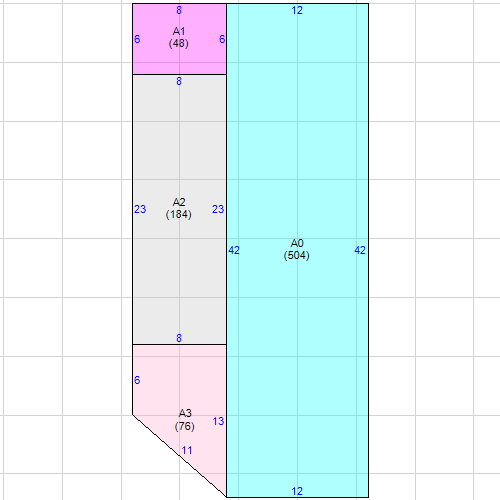

| Subarea and Square Footage for Building 1 |

| Code Description |

square Footage |

| BASE |

504 |

| SEMI Finished Base |

184 |

| OPEN Porch |

76 |

| OPEN Porch |

48 |

| Total Square Footage |

812 |

| Area Under Air |

688 |

|

| Sketch for Building 1 |

|

|